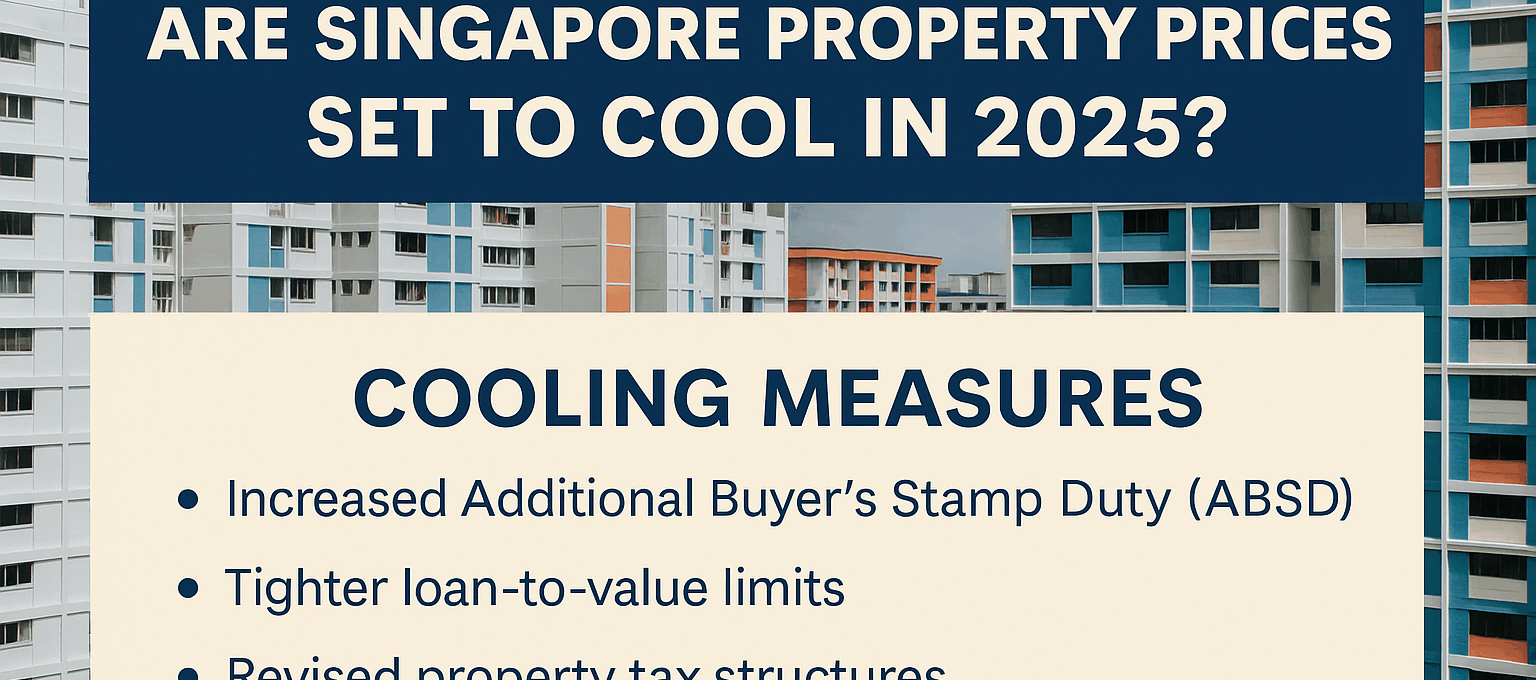

After several years of red-hot growth, the question on everyone’s mind is whether Singapore’s property prices are set to cool in 2025. From record-breaking private home sales to steadily rising HDB resale prices, the real estate market has seen unprecedented momentum. But as new government policies, economic headwinds, and global uncertainties take hold, the tide may finally be shifting.

One of the key signals pointing to a potential cooling is the government’s consistent implementation of cooling measures. In 2023 and 2024, increased Additional Buyer’s Stamp Duty (ABSD) rates for foreigners and investors, tighter loan-to-value limits, and revised property tax structures were introduced to manage speculative demand. These steps, combined with a cautious lending environment, have already started to dampen activity, particularly in the private residential sector.

At the same time, interest rates remain relatively high, following global monetary tightening. Although some analysts predict modest rate cuts in the second half of 2025, borrowing costs are still considerably above pre-pandemic levels. This affects affordability, particularly for upgraders and investors relying on leverage, which could translate into slower sales and more measured price growth.

On the supply side, 2025 will see a ramp-up in new home completions, especially for BTO flats and private condominiums launched in the past few years. As these units come onto the market, they may ease the current demand pressure and offer more options for buyers, further tempering price increases. The government has also committed to maintaining a steady pipeline of public housing, including new launches in popular estates like Tengah, Queenstown, and the Greater Southern Waterfront.

That said, prices are unlikely to drop drastically. Singapore’s property market remains underpinned by strong fundamentals: stable governance, limited land supply, and sustained demand from both locals and foreigners seeking a safe and appreciating asset. For HDB flats in particular, while resale prices may stabilise, desirable units in mature estates will likely retain value due to location and amenities.

For buyers, this could be an opportune time to enter the market with more room to negotiate and less pressure from bidding wars. For investors, it’s crucial to be more discerning—focusing on long-term potential, rental yield, and asset quality over short-term gains.

In conclusion, while 2025 may not bring a dramatic drop in prices, a cooling and stabilisation trend is highly likely. This creates a more balanced playing field where fundamentals matter more than hype. Buyers and investors who plan with realism and clarity will be well-positioned to make sound, strategic decisions in the months ahead.

Leave a Comment